Examine This Report about Employee Retention Tax Credit Retroactively Terminated

The Best Guide To The Employee Retention Tax Credit Can be Filed in 2022 for

However, Recovery Startup Organizations are still qualified for ERTC through completion of the year. A Recovery Startup Service is one that started after Feb. 15, 2020 and, in general, had approximately $1 million or less in gross receipts. They could be eligible to take a credit of up to $50,000 for the 3rd and fourth quarters of 2021.

The Employee Retention Tax Credit and Nonprofit Eligibility - Jitasa Group

Previously, the Consolidated Appropriations Act expanded credentials to include companies who took a loan under the Paycheck Defense Program (PPP), consisting of debtors from the initial round of PPP who originally were disqualified to claim the tax credit. Qualification is figured out by one of 2 factors for qualified employers and among these aspects should use in the calendar quarter the employer wishes to utilize the credit: A trade or business that was completely or partly suspended or needed to lower organization hours due to a government order.

Cares Act ERTC Application - Apply Online

The 20-Second Trick For What is the Employee Retention Credit? - Paychex

Some organizations, based upon internal revenue service assistance, typically do not meet this factor test and would not qualify. Those thought about vital, unless they have supply of crucial material/goods interfered with in manner that affects their capability to continue to operate. Also Found Here shuttered but able to continue their operations mostly undamaged through telework.

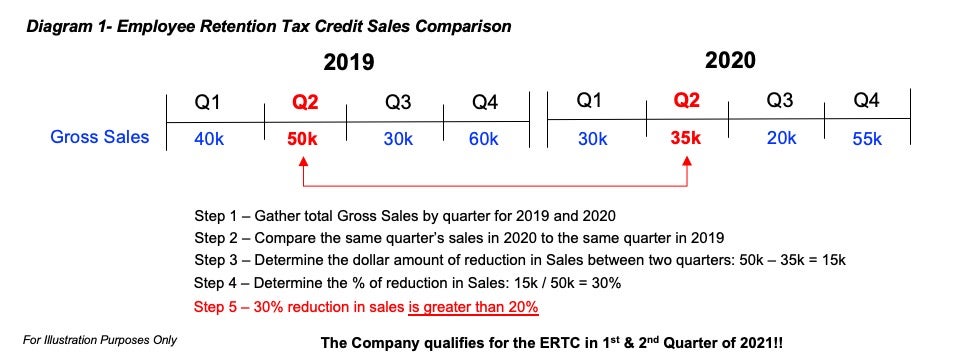

A company that has a significant decline in gross invoices. On Tuesday, Aug. 10, 2021, the internal revenue service launched Revenue Treatment 2021-33 that offers a safe harbor under which an employer may omit the amount of the forgiveness of a PPP loan and the amount of a Shuttered Venue Operators Grant or a Dining Establishment Revitalization Fund grant from the meaning of gross receipts exclusively for the function of determining eligibility to declare the ERTC.

An Unbiased View of IRS enhances employee retention credit guidance for open

CARES Act 2020 Usually, if gross invoices in a calendar quarter are listed below 50% of gross receipts when compared to the exact same calendar quarter in 2019, an employer would certify. They are no longer eligible if in the calendar quarter instantly following their quarter gross invoices surpass 80% compared to the exact same calendar quarter in 2019.